Real Estate Decision-Making: 7 Strategies for Avoiding Paralysis by Analysis

One common issue a real estate professional is facing, or has faced in their lifetime is Analysis paralysis, also some would say "paralysis by analysis,". It occurs when a real estate professional becomes so overwhelmed by the magnitude of information or even options that are available to them which led them to be unable to make a decision or take any action at all! As a professional in a fast-paced industry, this can be a major roadblock in their career, where quick decisions should be made with decisive action.

Some would say that it is just overthinking, but it is so much worse because it can and will lead to missed opportunities. If you as a real estate practitioner is constantly analyzing and reanalyzing every potential decision to the point that all you can think about is what to do for that decision, you may miss out on deals that require a quick response. This, of course, can be a major disadvantage.

Here at Unbundled Property Management, we talk about knowing your numbers often. This is a good reminder for you as a real estate professional to know your numbers. You coming across this blog article is no accident, this is an opportunity to remind you as a real estate property investor to track the financials of every single line item of a property. Knowing these numbers and figures will help you become more confident with your investment decisions in the future. We learn from these experiences, hence the more you know about your previous projects, the better decisions you can make in the future.

To help you with knowing your numbers in your real estate properties, we have prepared an Investment Calculator for you!

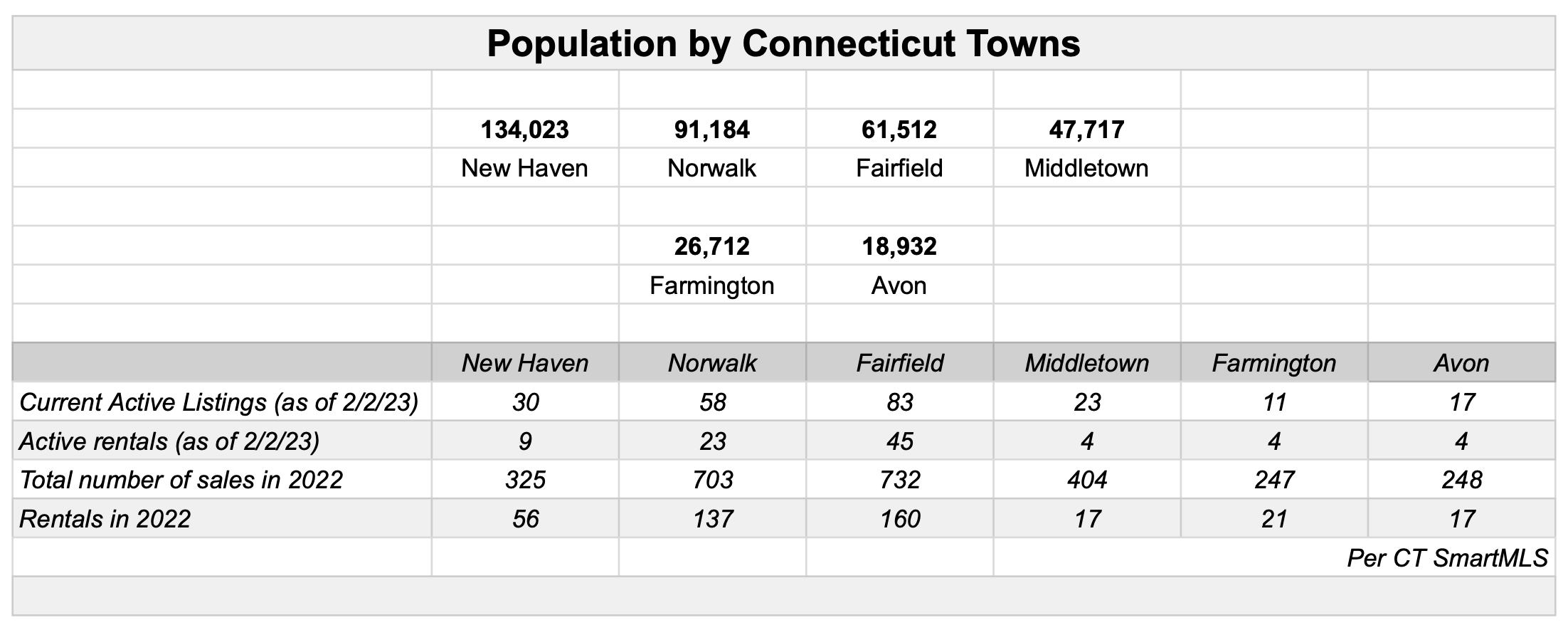

You should ask the right questions as well. It could be as simple as “What is the population of each town / city you want to invest in?” It doesn’t end there; you should then ask how many properties are currently on the market AND how many properties were sold in the past. The more data and historical information you can gather and filter the better. These numbers will vary widely and will no doubt have an impact on how many opportunities you will have to purchase a property.

Luckily, if you want to skip this questioning part for towns and cities like West Hartford, Milford, Glastonbury, Farmington, and others, you can visit our dedicated pages for some Connecticut cities here:

Rocky Hill CT, Glastonbury CT, Farmington CT, Avon CT, Newington CT, West Hartford CT, Windsor CT, Branford CT, Berlin CT, Madison CT, South Windsor CT, Wethersfield CT, and Milford CT.

In Connecticut there are 8 regions; Fairfield Region, Litchfield Region, New Haven Region, New London Region, Middlesex Region, Tolland Region, and Windham Region. At Unbundled Property Management, we manage properties throughout the entire state so our database includes every city and town but if you're just getting started you will want to start with some general information about your target markets. For this example we selected a variety of markets to show population vs. activity as of February 6, 2023.

This information can help answer some of the following questions:

Is this the market size I want to invest in?

What is the current inventory?

You may want to break this down to seasonally (or per month) so you can prepare for busier times of year, where there may be more opportunities to purchase.

What is the current demand vs. the past year?

Do the markets I’ve researched appear to have enough opportunities to fulfill my purchasing goals?

The above exercise just scratches the surface. Don’t expect one simple exercise like this to allow you to make a decision, the idea is for these types of exercises to lead you in a direction to make a decision.

Overthinking can lead to indecisiveness, which can be frustrating for partners, investors and yourself! If you're unable to make a clear decision, it can hold up the entire process and create unnecessary delays. This can lead to lost business.

7 Tips to Combat Overthinking and Analysis Paralysis:

Set clear goals and priorities: It is important to have a clear understanding of what you want to achieve before you even begin the decision-making process. This will help you focus on the most important information and narrow down your options. We at Unbundled Property Management have prepared for you a useful article about how to create an effective business plan.

Get a second opinion: Sometimes, it can be helpful to seek the insights of a colleague or mentor before acting upon a decision or while actually making that decision. They may have a fresh perspective or experience that can help you make a sound real estate decision.

Don't be afraid to make a mistake: Remember that making mistakes are part of the learning process, even if it might be our nature to want to have no mistakes and have everything put in place perfectly first time. Don't let fear of making a mistake hold you back from taking action. This is why we find it so important to gather experience through a mentor. Mistakes are a great way to learn but you do not want to make mistakes that affect your financial well being.

Set a deadline: Pro tip; if you're struggling to make a decision, and it has been setting you back for some time, try setting for yourself a deadline. This will help you focus and prioritize the most important information. Make the decision and move on. Get comfortable with not always making the “best” decision. There is a Ted Talk that explains “Good or Bad – Hard to say” – “Good or Bad are incomplete stories” they say in the Ted talk.

Create a decision-making process: Having a clear process for making decisions can help you stay organized and focused. This might involve creating a list of pros and cons, seeking input from others, or using a decision matrix to weigh the various options. By following a structured process, you can avoid getting bogged down in the details and make a decision more quickly.

A tactic someone once shared with me is asking this one simple question – does this align with my ultimate goal? Knowing your “big” goal and referencing that goal can help keep you on track when it comes time to make those “everyday” decisions.

Break it down: If you're faced with a particularly complex decision, it can be helpful to break it down into smaller, more manageable chunks. This will allow you to focus on one piece at a time and avoid getting overwhelmed by the big picture.

Trust your gut: It's easy to get caught up in the details and overanalyze a decision, but sometimes it's important to trust your instincts. If you have a strong gut feeling about a particular course of action, it's often worth considering.

Decision making is difficult! Especially, in real estate where many decisions come with a large price tag. Pay attention to your patterns and see if you can identify areas that challenge you when it’s time to make a decision, focus on getting more confident in these areas. It can be frustrating, upsetting, confusing and a laundry list of other emotions. An investor summed it up this way recently, feel the emotion - act on logic. Happy Investing!